Empowering Small Businesses: 5 Best Payment Solutions for 2023

Cassandra Goethe

Marketing Coordinator

Payment solutions and gateways have risen to the forefront as indispensable tools for small businesses, revolutionizing the way they conduct financial transactions. The dynamic and competitive business landscape demands adaptability, and these innovative payment platforms have emerged as a lifeline for entrepreneurs striving to keep pace with ever-evolving consumer preferences and demands.

The expansion of e-commerce and the shift towards cashless transactions have intensified the importance of such payment solutions for small businesses, helping them navigate the complexities of modern commerce more easily and efficiently. Gone are the days of traditional cash registers and cumbersome paperwork. Today’s cutting-edge systems present a convenient and secure way for businesses to process payments, both on and offline.

The solutions detailed here are intended to serve as companions for managing finances in new and improved ways. The integration of high-quality reporting and analytics features provides a way for small business owners to gain valuable insights into their sales trends, customer behavior, and revenue performance. Armed with this data-driven knowledge, entrepreneurs can make more educated decisions to optimize their business strategies, target specific markets, and maximize their revenue potential.

Why Should Small Businesses Use Payment Solutions?

Small businesses would be wise to consider utilizing payment plans like EBizCharge, Stripe, Tandym, Sezzle, Katapult, Affirm for a number of reasons. These payment solutions offer numerous advantages that can significantly benefit businesses in today’s competitive market.

First and foremost, businesses that provide payment plans can attract more customers by giving them flexibility and affordability. They can split their purchases into manageable installments, which can lead to increased sales and higher average order values.

Additionally, these payment platforms take on the risk of non-payment, which reduces the financial burden on small businesses. Once again, using such services can improve customer satisfaction as shoppers enjoy the ease and convenience of using these installment options. By catering to customers’ preferences and improving their overall shopping experience, small businesses can foster loyalty and generate repeat business.

But there’s more! Adopting these payment plans may also give small businesses the competitive edge they need to stand out from competitors. Their readiness to stay open to new opportunities positions them as modern and customer-oriented, two things every business wants to be.

The following payment solutions can be beneficial tools for small businesses seeking growth, customer retention, and financial stability in the current business landscape.

We want to make sure that SmartSites clients are taking advantage of the tools that allow you to do business most successfully. EBizCharge is the leading PCI-compliant payment solution that integrates directly into your CMS and allows your customers to pay via credit and debit card. Designed to integrate with a number of accounting systems, EBizCharge simplifies financial workflows and encourages efficiency.

SmartSites’ Favorite EBizCharge Features:

- 100+ integrations

- “No code” payment gateway connects to your Magento shopping cart

- Powerful payment security modules

- Qualifying transactions at level 3 processing rates

- Tokenized, off-site data storage

- Fully in-house

EBizCharge stands out for its ability to integrate with eCommerce, CRM, and ERP tools. The ease and security it offers in accepting payments and their commitment to providing top-notch customer support are unmatched. Overall, EBizCharge is our number one choice for clients wanting to streamline payment processes, enhance efficiency, and provide their customers with a seamless experience.

Stripe Payments’ processing supports multiple methods of payment, including debit and credit cards, digital wallets like Google Pay and Apple Pay, and local payment options.

SmartSites’ Favorite Stripe Features:

- Subscriptions and Recurring Billing: Stripe facilitates subscription-based business models by handling recurring billing and subscription management.

- Developer-Friendly: Stripe’s API and documentation make it a developer-friendly platform, allowing easy integration with websites and applications.

- Advanced Fraud Protection: Stripe employs machine learning algorithms and security measures to detect and prevent fraudulent transactions.

- Real-Time Reporting: Stripe’s intuitive dashboard provides real-time insights into transaction data, sales performance, and other financial metrics.

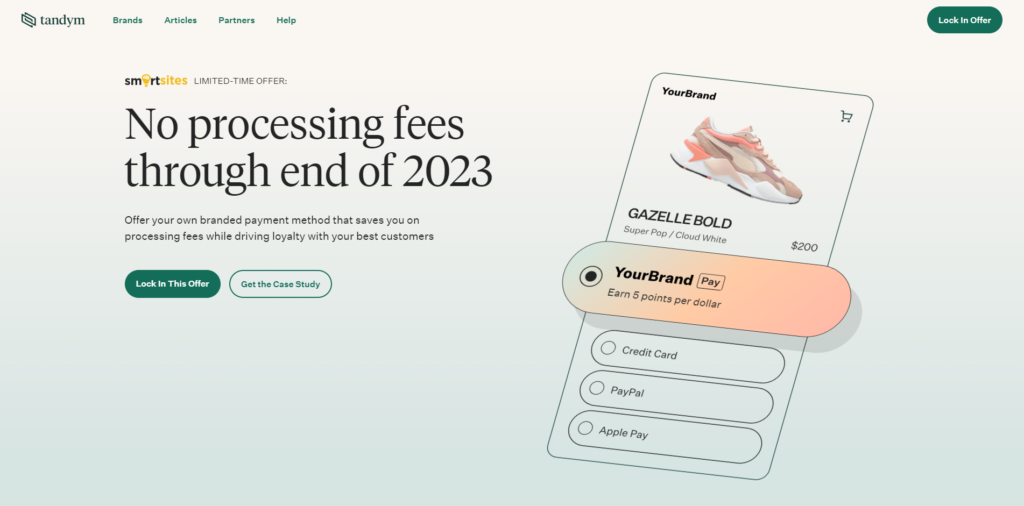

Tandym is an online payment solution that empowers merchants to establish and manage personalized digital cards and rewards programs. By utilizing Tandym’s platform, retailers can create tailored incentives to attract and retain customers, ensuring their ongoing engagement and loyalty. Moreover, Tandym distinguishes itself by offering merchants significantly lower transaction fees than traditional card programs like Visa and Mastercard. While conventional interchange fees for processing customer credit card transactions usually range from 2% to 3%, Tandym charges a mere half percent, leading to substantial cost savings for merchants.

In essence, Tandym redefines how retailers interact with their customer base while optimizing financial efficiency through reduced transaction costs.

Branded credit cards used to be an advantage held tightly by enterprise brands. Not anymore. Tandym levels the playing field, helping you improve LTV with your best customers by increasing purchase frequency and AOV while reducing processing costs by up to 80%. For a limited time, lock in zero percent processing fees on Tandym through the end of 2023. Learn more here: https://www.bytandym.com/smartsites

SmartSites’ Favorite Tandym Features:

- Multiple Payment Options: Tandym supports various payment methods, including credit and debit cards, e-wallets, and bank transfers.

- Secure Payment Processing: With adequate encryption and compliance with industry standards, Tandym protects data against unauthorized access.

- Recurring Payments: Tandym allows subscription-based billing and recurring payments, making it good for businesses with subscription models or recurring services.

- Customizable Checkout: Tandym helps businesses customize the checkout process, which creates a branded and personalized payment experience for customers.

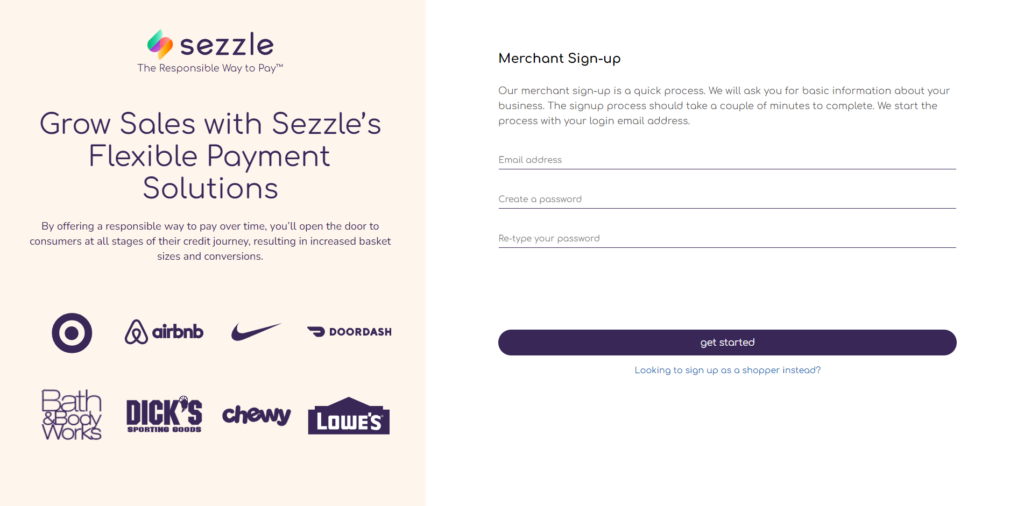

Sezzle is a revolutionary payment platform that is helping financially empower the next generation. With a mission to provide flexible and interest-free installment plans, Sezzle allows consumers to split their purchases into four equal, interest-free payments over six weeks. With this flexible payment option, Sezzle helps small businesses attract more customers and increase sales.

SmartSites Favorite Sezzle Features:

- Interest-Free Installments: Sezzle’s unique selling point lies in its interest-free installment plans. This feature appeals to budget-conscious customers who prefer breaking down larger purchases into smaller, more manageable payments.

- Higher Conversion Rates: By catering to consumers who may have otherwise been deterred by a lump-sum payment, Sezzle can increase a small business’s conversion rates, leading to higher overall sales.

- Smooth Integration: Sezzle flawlessly integrates with a number of e-commerce platforms, making it easy for small businesses to work the solution into their existing systems.

- Risk-Free Transactions: The platform assumes the risk of customer chargebacks and fraud, providing small businesses with added security and peace of mind during transactions.

- Boost in Customer Loyalty: Offering payment flexibility through Sezzle can promote customer loyalty, encouraging repeat purchases and positive word-of-mouth marketing.

In the realm of lease to own payment options, Katapult reigns supreme. By offering innovative alternative payment solutions, Katapult reshapes the landscape. What sets Katapult apart is its commitment to inclusivity – unlike traditional models, it doesn’t hinge on credit scores for lender approvals. This opens doors to durable goods ownership for the 30% of shoppers who often find themselves overlooked by conventional payment avenues. They have a consumer-centric focus which ensures a quick application and approval process, transparent terms, and tailored payment plans.

SmartSites’ Favorite Katapult Features:

- Lease-to-Own Model: Katapult’s lease-to-own model appeals to consumers who may not have access to traditional credit or prefer to avoid long-term commitments.

- Instant Credit Decisions: Katapult provides instant credit decisions.

- No Credit Hassles: Katapult firmly believes that your financial history should not limit your access to life-enhancing products.

- Seamless Integration: Katapult works with a number of e-commerce platforms.

- Risk Mitigation: By managing customer payments and ownership, Katapult minimizes the risk for merchants. This helps reduce defaults or missed payments.

- High Approval Rates: Katapult offers high approval rates.

Do You Need Help Choosing the Right Payment Solution for Your Business?

Boost your business with SmartSites – your premier digital marketing partner!

Are you struggling to find the perfect payment solution for your business? We personally recommend Sezzle and can help you set it up. Or do you need help with other essential aspects like marketing, web design, SEO, email/SMS marketing, and more? Look no further! SmartSites is here to help!

Unleash Your Business Potential – Stay ahead of the competition with SmartSites’ best-in-class digital marketing services. Our team of more than 300 dedicated experts is committed to providing top-notch solutions tailored to your specific needs.

Experience Growth Like Never Before – Get ready to witness a surge in traffic, customer acquisition, and sales. At SmartSites, we pride ourselves on delivering proven strategies and reliable execution that exceed your marketing goals.

Join the Global Movement – Our cutting-edge strategies and digital marketing trends have made us sought-after speakers as keynotes across the globe. We bring the latest innovations directly to your doorstep.

Reach Out to Our Experts Today – Ready to take your business to the next level? Speak with our marketing experts now! Contact us at 201-870-6000 or use our convenient online form to get in touch.

Put your business on the path to success with SmartSites! Let’s grow together!

Free

Consultation

Free

Consultation Free

Google Ads Audit

Free

Google Ads Audit