How PPC Marketing Boosts Success for Insurance Agents

Clement Foo

Senior Digital Content Manager

The insurance industry is highly competitive. For this reason, it’s challenging for agents to stand out and attract new clients. Traditional marketing methods, such as word-of-mouth and referrals, are no longer enough to sustain long-term growth. With more consumers turning to the internet to research and compare insurance providers, digital marketing has become necessary for success. Pay-per-click (PPC) marketing offers insurance agents a powerful way to reach potential clients by placing targeted ads directly in front of people actively searching for insurance services. With PPC marketing for insurance agents, you can increase visibility, drive high-quality traffic to their websites, and generate more leads efficiently.

Immediate Visibility in a Competitive Market

One of the biggest advantages of PPC marketing is its ability to provide immediate visibility in search engine results. Different from search engine optimization (SEO), which takes time to build rankings, PPC ads appear at the top of search results almost instantly.

This is especially valuable for insurance agents who need to compete against larger firms and aggregators. With the right keywords and ad placements, PPC makes sure that potential clients find an agent’s services at the exact moment they need them.

In particular, Google Ads allows insurance agents to bid on high-intent keywords, such as “best home insurance in New York” or “affordable car insurance near me.” Targeting these searches, agents can connect with individuals who are actively looking for insurance solutions. This leads to higher conversion rates compared to general digital advertising.

Targeted Advertising for Quality Leads

One of the biggest challenges for insurance agents is attracting the right audience. PPC marketing provides advanced targeting options that help agents reach their ideal clients.

Platforms like Google Ads and Facebook Ads allow for audience segmentation based on location, demographics, interests, and search intent. This makes sure that marketing budgets are spent on prospects who are most likely to convert into policyholders.

For example, an insurance agent specializing in small business insurance can target entrepreneurs and business owners within a specific geographic area.

Similarly, an agent offering life insurance can focus on individuals searching for financial planning solutions. PPC eliminates wasted ad spend and increases the likelihood of generating qualified leads by narrowing down the audience.

Cost-Effective Lead Generation

PPC marketing operates on a pay-per-click model. This means agents only pay when someone clicks on their ad. For this reason, it is a cost-effective solution compared to traditional advertising methods such as billboards, TV commercials, or direct mail campaigns. With proper campaign management, insurance agents can achieve a strong return on investment (ROI) by converting clicks into clients.

Agents have full control over their advertising spend by setting daily or monthly budgets. PPC platforms also provide performance analytics and allow agents to track which ads are generating the most leads. The data-driven approach enables continuous optimization. As a result, marketing dollars are allocated to the most effective campaigns.

Enhancing Brand Credibility and Trust

Consumers tend to trust businesses that appear at the top of search results. Insurance agents can enhance brand credibility and establish themselves as trusted providers in their industry by securing prime ad placements through PPC. This is especially important for new or independent agents who are competing against well-established insurance companies.

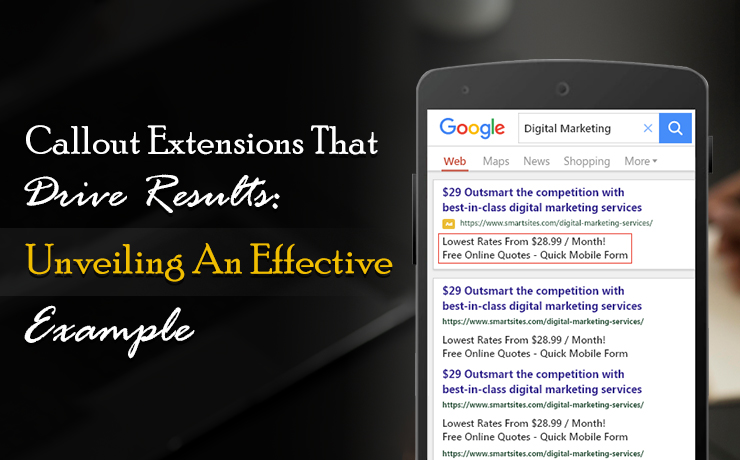

Additionally, incorporating ad extensions such as customer reviews, ratings, and call buttons can improve ad visibility and encourage user engagement. These features make it easier for potential clients to contact an agent directly–further increasing conversion rates.

PPC Remarketing for Higher Conversions

Not all website visitors convert into leads on their first visit. PPC remarketing allows insurance agents to re-engage potential clients who have previously visited their site but did not take action. Agents can remind them of their services and encourage them to return and complete a purchase by displaying targeted ads to these users across various platforms.

For instance, if a visitor browses a website’s home insurance page but leaves without filling out a quote form, remarketing ads can remind them to come back and request a quote. The strategy keeps insurance agents top of mind and increases the likelihood of converting interested prospects into policyholders.

Grow Your Insurance Business with SmartSites

PPC marketing is a game-changer for insurance agents looking to expand their client base and increase revenue. With precise targeting, cost-effective lead generation, and instant visibility, PPC allows agents to attract high-quality leads and convert them into long-term clients. With search ads, remarketing strategies, and data-driven optimization, insurance agents can stay ahead in a competitive market. SmartSites specializes in PPC campaigns tailored for insurance professionals. Our team of digital marketing experts guarantees that your ads reach the right audience at the right time. This helps maximize your return on investment. Whether you’re new to PPC or looking to improve your current strategy, SmartSites can help you drive more leads and grow your insurance business. Start building a PPC strategy that delivers real results for your agency.

Free

Consultation

Free

Consultation Free

Google Ads Audit

Free

Google Ads Audit